Welcome to the “Blockchain Revolution.” Here we peel back the layers on Comparing traditional vs. blockchain-based systems in different industries, highlighting how sectors are shifting gears from the old to the new. From banks that count on consistency to FinTech startups making waves with speed, we’ll dive deep into the changes shaking up finance. In insurance, we’re seeing old forms pivot as smart contracts cut fraud and waste. Stick with us, and explore how DeFi isn’t just a buzzword – it’s expanding the whole financial playground. Buckle up; it’s quite the ride!

Blockchain Transformation in the Finance Sector

Understanding Blockchain Impact on Traditional Financial Systems

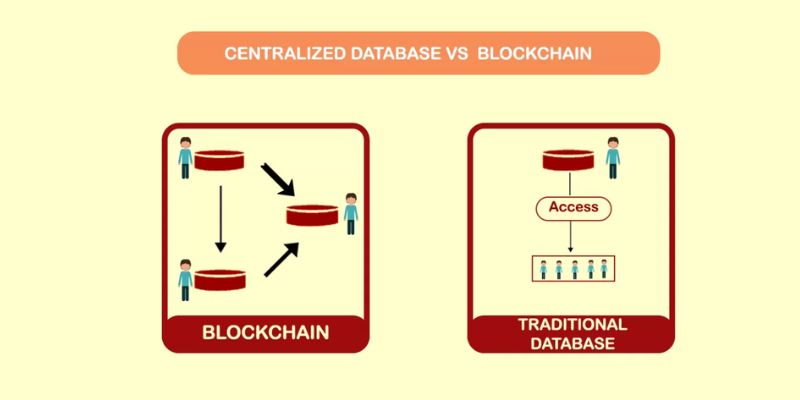

In finance, change is here. Blockchain shakes things up. It brings in fresh methods. This tech rewrites the rules. In the past, we had big banks and slow money moves. Now, we see prompt trades and clear info. This happens with no middle man.

People ask, “What is blockchain?” It’s a list of records linked and secure. Each piece has data from a financial move. All see it, so it’s clear who owns what. This stops fraud—a big win for trust.

Banks now face a question: Stick to old ways or leap to new tech? Embracing blockchain, banks win fast deals and save money. But they must learn new skills. And skills take time to gain.

Innovations Brought by Blockchain to Enhance Financial Security and Efficiency

Security gets a boost with blockchain. It makes sure deals are safe. Each block ties to the last. To change one, all blocks after must change. This is hard to do. It stops bad actors in their tracks. We can trust our money is safe.

Efficiency also jumps up. Sending money across borders takes days with banks. With blockchain, it’s just minutes. This cuts wait times. It can also lower fees. This is good news for those who send money home to their families abroad.

Smart contracts are a perk in this mix. They carry out deals when terms are met. No need for a go-between. This saves time and hassle. Many look to smart contracts in insurance. They make claim times shorter. They spot fraud better.

We see transparency in supply chain management. We track goods from start to finish. This has huge value in fields like the pharmaceutical industry. It means we can trust our meds are safe.

Blockchain also plays its part in banking. It makes a huge jump in banking transaction speeds. Payment processing is more brisk now. Records are clear and open.

So yes, blockchain changes the game in finance. It makes for quick, safe money moves. It brings trust and clear view to our deals. It saves time and money. And it could pave the way for money without borders. We’re still early in this shift. But one thing is sure—it’s a change worth watching.

Disruptive Power of FinTech Compared to Traditional Banks

Analysis of Service Delivery: FinTech Efficiency vs. Bank Reliability

Imagine you could bank as quickly as sending a text. That’s FinTech. These tech-savvy players change how we use money. Their secret? Think apps that make banking as easy as chatting with friends. Now, compare this to waiting in line at a bank. You can feel the difference. FinTechs use cool tech like blockchain for faster, cheaper services. This puts pressure on banks to speed up and cut fees. Remember waiting days for a payment to clear? Not anymore. FinTech apps often make it happen in seconds. But, banks have trust and history on their side. So, people sometimes worry less with banks. Knowing this, banks are now tech-ing up, tapping into blockchain to keep up.

Strategic Adaptations for Banks Facing FinTech Innovations

Banks have seen FinTech coming and are not sitting ducks. They’re getting into the tech game too. Big banks are now building apps and using blockchain. They are not just about vaults and tellers anymore. Banks offer tech services, hoping to keep their customers. They’re also teaming up with FinTechs, using their tech to get better. Not just competing but also completing each other. This is how banks stay in the fight. They keep what customers love and add new tech. So banks combine their big, safe image with new, fast ways to bank. This mix helps banks stay strong, even as FinTech changes the game.

Banks and FinTechs both have good bits. FinTechs offer new, quick tech, and banks have years of trust. Together, they can give us a way to handle money that’s both fast and safe. Now, that’s a win for everyone.

Implementing Smart Contracts in the Insurance Industry

Benefits of Blockchain-Driven Automation in Insurance Processing

Let’s cut to the chase: insurance is a hassle. Long forms, slow claims, and errors along the way. But there’s good news. Imagine a world where claims are so smooth, you barely lift a finger. That’s blockchain for you. With smart contracts, things move fast.

Smart contracts on blockchain make promises without breaks. They’re like tiny, super strict robots checking everything in a deal. When conditions are met, like say your car goes ‘boom’, they instantly start the payout process. No waiting, no calls – it’s automatic. Now, isn’t that a breath of fresh air?

By reducing touchpoints, blockchain cuts the chance of mistakes. We all know errors mean more time and more money. Smart contracts in insurance keep it straightforward. Plus, they’re locked tight, which means safer personal info. Privacy is a big deal, and blockchain keeps it under lock and key.

Reducing Fraudulent Claims Through Smart Contract Technology

Now, let’s tackle a big monster: insurance fraud. It’s a tough fight but guess who’s tougher? Blockchain. Going digital with smart contracts makes every step clear as day. It’s like having a lie detector hooked up to your claim. Truth only, no room for trickery.

With smart contracts, every part of your policy is checked. If something’s off, red flags pop up right away. This tech has an eye for lies, spotting fakes in a flash. It keeps your money safe and sound, and cheaters find no ground.

Picture this: someone has a small bump on their car and says it’s a total wreck. Or better yet, they claim for an invisible friend. Smart contracts go, “I don’t think so!” and shut those fake claims down. Insurance money goes to the right people, and we all pay fair premiums.

Think of smart contracts as your friendly neighborhood watch. They’re always on duty, keeping an eye out for the good of all. In the big picture, this tech protects the money pool and makes sure we’re all playing by the rules. Cheaters get the boot, and honesty gets a high five.

By using this amazing tech in insurance, claims get settled quick and with no fuss. It saves us all from headache and injustice. It’s a win-win that I’m all for. Can’t wait to see more insurers jump on this smart contract bandwagon!

Decentralized Finance (DeFi) and Its Rise in the Financial Ecosystem

Examining DeFi’s Contribution to Inclusive Financial Systems

Let’s dig into DeFi’s big win: reaching those left out by banks. Banks often miss folks due to high costs and stiff rules. But DeFi changes this. It uses blockchain for all to access finance. This means even someone far from a bank can join in. They need just the internet and a phone.

How does DeFi reach more people? DeFi skips the middleman. No banks or credit checks. You just jump on an app, and get going with loans or trades. This is huge for fairness. DeFi doesn’t care who you are or where you’re from. It’s all about your digital skills and smarts.

DeFi is also a friend to people with little cash. You can start small. You don’t need piles of money just to get in the game. People can now save, borrow, or grow money in new ways. This was tough before, without banks on board.

Investing in DeFi: Opportunities and Market Trends Analysis

Next up, making money with DeFi. It’s the wild west out there, but with huge wins for early birds. So many folks are now turning to DeFi instead of old-school stocks or bonds. They’re finding new chances to invest and seeing their money grow fast.

What’s hot in DeFi right now? Tokens and apps that let you trade or lend are soaring. New projects pop up often, each with cool new twists. Some offer rewards just for using their systems, like free tokens. Others might let you vote on how things run. It’s like having a say in your bank but way cooler.

But tread lightly, it’s not all rainbows. With high rewards, come high risks. You might make money but you can lose it too, and fast. And sadly, some run into scams. So you gotta be sharp and think before you leap.

DeFi is also shaking up how we view money itself. With DeFi, money flows quick, with few roadblocks. This makes it a top pick for folks tired of waiting on slow bank moves. It’s all about speed and getting your cash to work fast.

So there you have it. DeFi is making finance fair and fun. It’s letting people in from all over, with cash big or small. And if you’re smart, and a bit lucky, there’s money to make. But as always with cash, look before you leap. Keep those eyes wide open and dive into DeFi. It might just be the financial flip your life needs.

We’ve looked at how blockchain changes finance and makes things safer and faster. We saw how tech-savvy firms shake up the game, forcing banks to step up. We explored smart contracts cutting fraud and speeding up insurance claims. We also dived into DeFi, a big player in making finance open to more people and the new chances it brings.

My final thought? These shifts are huge and they’re just starting. Banks, insurance, and investment all feel the impact. This is a thrilling time in finance, with tech like blockchain leading the charge. Get ready for a smarter, more open financial world that works better for everyone. There’s a lot to explore, so keep learning and stay ahead!

Q&A :

What are the key differences between traditional and blockchain-based systems in various industries?

Blockchain-based systems differ from traditional systems primarily in terms of decentralization, transparency, and security. In industries like finance, supply chain, and healthcare, blockchain offers a decentralized ledger that is immutable and allows for transparent transactions without the need for a central authority, whereas traditional systems rely on centralized databases and intermediaries.

How do blockchain-based systems improve security compared to traditional systems?

Blockchain improves security by employing cryptographic algorithms and decentralization, making it nearly impossible to alter records without detection. Each transaction is recorded on a block linked to a chain, creating a tamper-evident sequence. This contrasts with traditional systems where central servers can be a single point of failure and more susceptible to hacking and data breaches.

In what ways can blockchain-based systems enhance efficiency in different industries?

Blockchain-based systems can streamline processes, reduce paperwork, and eliminate the need for intermediaries, which can lead to significant cost savings. For instance, in the supply chain industry, blockchain enables real-time tracking of goods and reduces the likelihood of counterfeit products, while in banking, it can expedite cross-border payments and settlements.

What challenges do industries face when integrating blockchain technology into their traditional systems?

Integrating blockchain into traditional systems poses several challenges, including scalability, regulatory compliance, and interoperability. Existing systems must be adapted to work with blockchain’s distributed ledger, and stakeholders must reach a consensus on the changes. Additionally, industries must navigate the evolving regulatory landscape related to blockchain technology.

Can blockchain technology be integrated with traditional systems, or does it require a complete overhaul?

Blockchain technology can often be integrated with existing traditional systems, but the extent of integration varies depending on the use case and industry. Some applications may benefit from a hybrid approach, combining the strengths of both blockchain and traditional systems, while others might require a more foundational change to fully leverage the benefits of blockchain. Integration strategies must consider the specific needs of the business as well as the technical and organizational challenges involved.