The cryptocurrency market’s wild price swings can feel overwhelming and unpredictable, especially for newcomers. However, beneath this volatility lies a repeating pattern. Our guide on crypto market cycles explained for beginners demystifies these trends, providing a clear framework to understand why the market moves in waves. This knowledge is your first step toward navigating the crypto space with more confidence and strategy.

What is a crypto market cycle

A crypto market cycle is the periodic pattern of price movements observed in the cryptocurrency market. It is not random chaos but a recurring sequence of stages driven by technology adoption, investor psychology, and broader economic factors. Think of it like seasons; while you cannot predict a specific day’s weather, you know winter eventually gives way to spring. Understanding these cycles helps you gain perspective on market volatility, moving from reactive fear to a more strategic, long-term viewpoint.

This guide on crypto market cycles explained for beginners highlights several core truths. These patterns are not unique to digital assets; they mirror traditional markets, often visualized by the Wall Street Cheat Sheet. The entire cycle consists of four distinct phases that repeat over time, primarily fueled by collective emotion. This shows how investor fear and greed can impact market stability and drive prices from euphoria to despair.

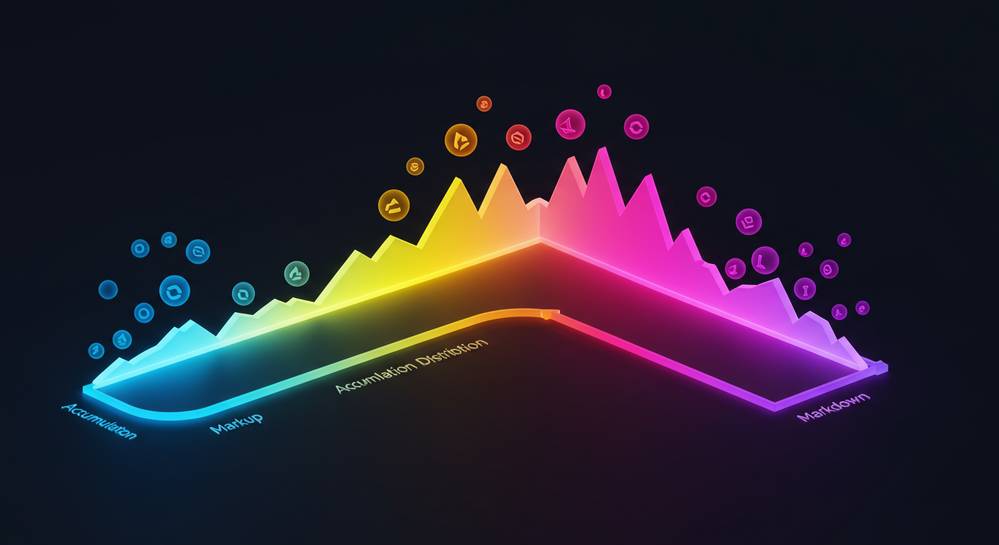

The four phases of a crypto market cycle

Every crypto market cycle unfolds in four distinct phases, each driven by collective investor sentiment. Recognizing the current phase is a crucial skill for any investor, as every stage offers unique risks and opportunities. This progression from optimism to despair and back again is a core concept for anyone seeking to have the crypto market cycles explained for beginners. Understanding these stages helps you anticipate market shifts rather than just reacting to them.

- Accumulation: Following a major crash, prices are low and move sideways. Media attention is minimal, and smart money begins buying assets from discouraged sellers.

- Markup: Prices start a steady upward climb, attracting new investors. Optimism grows, eventually leading to euphoria and FOMO near the peak.

- Distribution: At the market top, early investors begin selling to enthusiastic newcomers. Prices become volatile as supply overwhelms demand, a classic indicator when learning how to identify a stock market bubble.

- Markdown: The downtrend begins, turning denial into panic. This phase continues until sellers are exhausted, preparing the ground for the next accumulation phase.

What are the primary drivers of these cycles

Crypto market cycles are not random; they are propelled by a powerful combination of human emotion, technological progress, and economic forces. Understanding these core drivers is essential for anyone wanting crypto market cycles explained for beginners. These elements work together to create the markets predictable, yet volatile, rhythm. Gaining insight into these forces helps you see the logic behind the chaos and market movements.

- Investor Psychology: This is the most significant driver. The collective emotional swing from extreme fear to greed creates the peaks and troughs. FOMO pushes prices to unsustainable levels, while FUD causes panic selling below fair value.

- The Bitcoin Halving: Approximately every four years, the reward for mining new Bitcoin blocks is cut in half. This supply shock has historically been a major catalyst for a new bull market by reducing the rate of new supply.

- Technological Innovation: Breakthroughs like DeFi, NFTs, or new undefined platforms can spark immense interest and investment. As real-world use cases grow, they attract more capital.

- Macroeconomic Factors: Cryptocurrencies do not exist in a vacuum. Global economic conditions, such as interest rates, inflation, and regulations, significantly impact investor risk appetite and capital flow.

How beginners can navigate crypto cycles effectively

For a beginner, the volatility of crypto cycles can be intimidating. Instead of trying to perfectly time the tops and bottoms, the key is to develop a sound strategy based on understanding these patterns. A disciplined approach can help you manage risk and build a position over the long term. This is the most practical part of having crypto market cycles explained for beginners.

Adopt a long term perspective

Market cycles play out over years, not days. Avoid making emotional decisions based on short-term price swings. Zoom out and look at the bigger picture. Historically, despite massive downturns, the crypto market has shown long-term growth. Having a multi-year investment horizon is your greatest advantage against volatility.

Consider dollar cost averaging (DCA)

Instead of investing a lump sum, Dollar-Cost Averaging involves investing a fixed amount of money at regular intervals. This strategy helps reduce the impact of price swings. By buying consistently, you purchase more coins when the price is low and fewer when it is high, averaging out your entry cost over time.

Do your own research (DYOR)

Never invest in a project based solely on hype. Understand what the project does, who the team is, and its potential for long-term value. A solid understanding of your investments will give you the conviction to hold through a bear market and avoid panic selling.

Understanding crypto market cycles transforms your perspective from a gambler to a strategist. Recognizing the four phases—accumulation, markup, distribution, and markdown—provides a map for navigating volatility. Instead of fearing downturns, you can view them as opportunities. For more insights into technology and digital assets, explore the resources on Modern Techera and build your knowledge for the long term.